Frequently Asked Questions & Background

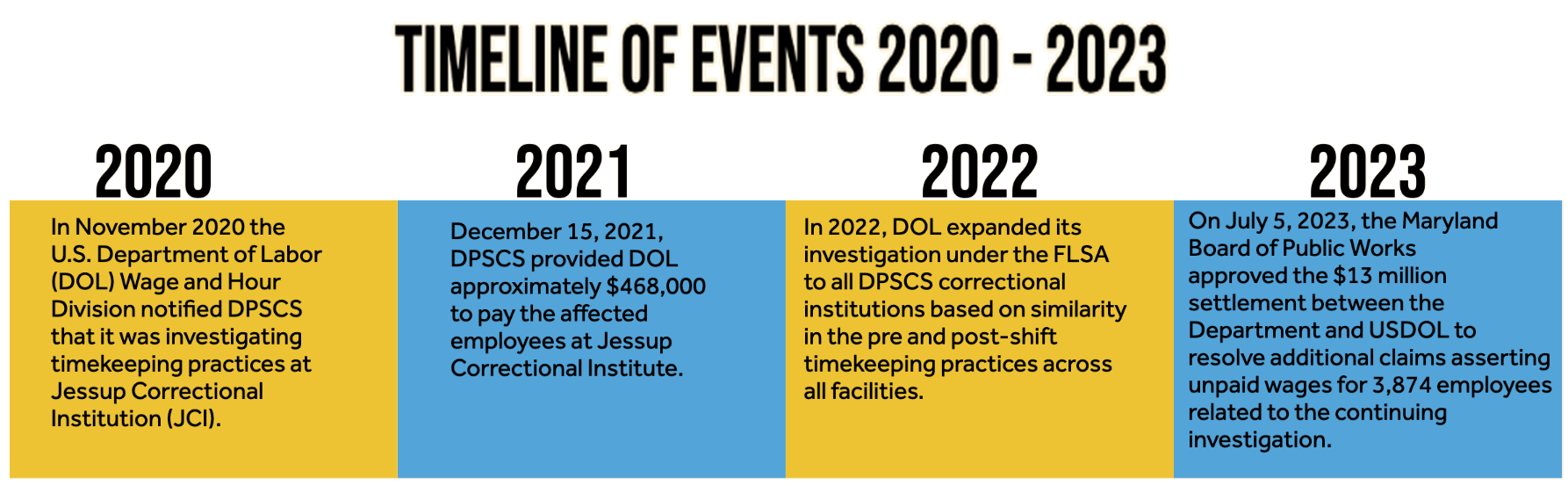

In November 2020, U.S. Department of Labor (USDOL) Wage and Hour Division notified the Department of Public Safety and Correctional Services (the Department) that it was conducting an investigation into time-keeping practices at Jessup Correctional Institution. In particular, it examined the alleged failure to properly pay overtime for employees who worked past the scheduled end of their shift, a violation of the Fair Labor Standards Act (FLSA), during the period of November 6, 2018 through August 4, 2021. It determined that certain employees were working past the end of their shifts, but because the signed approval from a supervisor was not obtained, overtime was not being paid. The Department ultimately agreed that in those instances, overtime was worked and should have been paid. On December 15, 2021, the Department provided USDOL with approximately $468,000 to pay the affected employees at Jessup Correctional Institution.

In 2022, USDOL expanded its investigation under the FLSA to all state correctional institutions based on similarity in the pre and post-shift timekeeping practices across all facilities. During the investigation period, the Department executed universal changes to its timekeeping system beginning in August 2021 as a remedy to these practices. In support of USDOL, the Department engaged in an analysis of 3,874 current and former employees who held the classifications of Correctional Officer I, Correctional Officer II, and Correctional Officer Sergeant and submitted these calculations to USDOL. On July 5, 2023, the Maryland Board of Public Works approved the $13 million settlement between the Department and USDOL to resolve additional claims asserting unpaid wages for 3,874 employees related to the continuing investigation.

The Moore Administration continues working closely with AFSCME and USDOL to resolve this issue quickly. To ensure all parties eligible for due compensation under FLSA are accounted for, the Department continues examining overtime data to determine which other classifications were subject to the same inaccurate timekeeping practices. The Department is focusing first on correctional supply officers, correctional dietary officers, and correctional maintenance officers, following the same method of back wages calculation used for correctional officers. If other classifications of employees are found by the Department to be within the eligible category, they will be addressed in this next phase of the investigation. The Department will review the final criteria with the USDOL prior to finalizing amounts due. The Department will submit a revised file with total back wages due to DBM and BPW for approval, and then to the Wage and Hour Division for processing.

Click questions to see answers for all the Frequently Asked Questions-

What did the US Department of Labor find in its investigation?

-

While this investigation is still ongoing and final determination has not been made or published by US Department of Labor (USDOL), there have been no findings or penalties assessed for willful violation of the FLSA. The Department has continued to cooperate fully with USDOL investigators in identifying the maximum amount of back wages potentially due to eligible affected employees. Upon reviewing Departmental policies and practices, USDOL determined that correctional officers who were delayed in their post relief did not need additional authorization for this time to be treated as authorized overtime, and differences between scheduled end of shift and actual end of shift due to continuation of job duties should be presumptively authorized. Additionally, early clock-ins before roll-call time that occurred due to door entry procedures were similarly authorized. At the same time, timeclock practices in the Time Clock Plus program that rounded this time up or down should be paid as minute-for-minute due to the duties and eligibility status of correctional officers. The Department changed its timekeeping practices and is revising its overtime documentation policy accordingly.

-

-

What did the Department do to fix this?

-

The Department universally disabled this rounding feature of Time Clock Plus in August 2021 for all facilities, in keeping with the expanded scope of USDOL’s investigation. The Department has also drafted a new timekeeping policy reflecting that employees do not need to seek overtime authorization for incidental periods of overtime worked involuntarily, such as late relief.

-

-

What time period does the investigation cover?

- The investigation includes time worked between November 2018 and August 2021. Employees who worked for the Department during this time period who recorded their time through Time Clock Plus and did not enter their own time in the Workday System may have been impacted based on their overtime eligibility.

-

What classifications were included in the investigation prior to July 5, 2023?

- Current and former Correctional Officer I, Correctional Officer II, and Correctional Sergeants who worked during this period were included in the initial investigation. In addition to the back wages approved by the Board of Public Works on July 5, 2023, the Department is continuing the examination of records to ensure eligible Correctional Officer I, Correctional Officer II, and Correctional Sergeants owed back wages receive payment. The Department will present any additional back wages based on the aforementioned criteria for future approval by USDOL.

-

What classifications are included in the investigation after July 5, 2023?

- The Wage and Hour Division requested an examination of other classifications for potential back wages due. This examination is currently underway but will first examine the correctional dietary officer series, the correctional maintenance officer series, and the correctional supply officer series, as well as Maryland Correctional Enterprise workers who could have been affected by the timekeeping practices within the Time Clock Plus system. These classifications may be included if their overtime eligibility indicates back wages are due, and they will be determined following the same method of back wages calculation used for previously compensated employees. The Department will confirm eligibility with the USDOL for any additional classifications impacted.

-

How do I know if I am owed back wages?

The Department of Public Safety and Correctional Services (DSPCS) has provided names and contact information to the USDOL. Per USDOL process, they will contact affected employees directly via letter. However, employees can have their checks processed faster by using the Workers Owed Wages page. The Wage and Hour Division provides a public facing lookup tool for employees who are owed back wages that have been paid to the USDOL as part of an investigation. DPSCS employees looking for their eligibility should search under the following terms to see any back wages:

. MD Dept. of Public Safety and Corrections

. Jessup Correctional Institute

Current and former employees can then directly confirm the amount due, their current mailing address, and then upload the necessary documentation for processing a Treasury check. Once those steps are completed, processing time is approximately 6 weeks.

- How much money will I receive?

The investigation totaled any previously uncalculated minutes before and after shift end, which was then compensated at the employees latest overtime rate. This may result in payments that are for more than the overtime rate at the time the hours were earned. For terminated employees, the latest overtime rate recorded was used. Because every employee’s timesheets and overtime rates were different, individual amounts may vary. All employees receiving payment directly from the US Department of Labor are being compensated for more than $20.00. Some employees may be owed back wages which will be paid directly by the State of Maryland. This group of employees will be submitted for payment after the investigation closes to ensure there are no additional monies owed that would require payment through USDOL.

Some employees in the Jessup region who were part of the first settlement group have already been compensated for the period in question. Some may have had additional time calculated beyond that period, which may result in a second compensation through USDOL.

- How was the amount owed calculated?

- The investigation totaled any previously uncalculated minutes before and after shift end, with the offset of any paid roll call time that was already applied in prior paychecks. This total was then compensated at the employee’s latest overtime rate. This method ensured the back wages accounted for any wage increases that could have occurred during the period.

- How will I receive my payment from this investigation?

- Employees entitled to payments totaling more than $20.00 will have payments supervised by the Wage and Hour Division of the USDOL. USDOL will send letters to the affected employees indicating that they are owed back wages, and employees will have to return a form with some identification information and a current address, and then a check will be issued by USDOL. The process should take 6-8 weeks before employees receive payment in the form of a check.

- I see that I am eligible for a payment from USDOL, but I have moved, how can I update my address?

- Once you have confirmed that the USDOL has received a payment for your backwages, you can directly confirm your identity and current contact information using the Workers Owed Wages page. Once those steps are completed, processing time is approximately 6 weeks.

- If I am owed less than $20, how will I receive my payment?

- Employees whose total back wages due were less than $20.00 were not eligible for payment supervision by WHD, and instead will receive their back wages directly from the State of Maryland.

- How do I verify my address is correct in WorkDay?

- Current employees can review and change their address of record using the Change Contact Information Page in Workday. An easy how to guide is produced here by the Department of Budget and Management.

- I worked for the Department during this time, but I didn't receive a payment, why not?

Only those Department employees working as cash-overtime eligible correctional officers who used TimeClock Plus during this period had eligible time. If you worked in those categories during that period it is possible that your unit was already utilizing minute for minute pay recording, and there was no discrepancy of unpaid minutes for those pay periods. Individuals who clocked in late were not penalized minutes, but had those clock-ins counted as 0 minutes early. If you believe that you are owed time and have not been contacted by the WHD, check the Workers Owed Wages database to ensure that notification did not go to the wrong address.

- What if I did not receive a payment, but think I might have unpaid overtime between November 1, 2018 and April 8, 2022?

Not all employees who clocked in using Time Clock Plus during this time had their recorded payroll affected by the system policies that were an issue. Many employees outside these classifications use Time Clock for attendance, but are still responsible for entering and validating their own time into Workday. These employees are not affected by this investigation because their payroll is correct.

If you do not enter or have your time approved by a supervisor in Workday and have questions about your eligibility, first review your position information in Workday to confirm that you are a non-exempt employee.

- I received payment but I have questions about my time worked. Where can I review my time?

Current employees who would like to review historical timekeeping records for minute for minute accuracy can access them at home using the Time Clock Plus Web Clock application. By providing their state-issued Workday Number and personal PIN, employees can view and export closed accruals back to the inception of the system. This tool will not reflect payment for the authorized 12 minute overtime paid for roll call attendance, which can be viewed in historical timesheets using the statewide Workday system.

Former employees can access their historical records through this link using the same information and instructions as current employees. Former employees with access issues can contact 410-585-3434 for PIN reset.

Instructions for portal use can be found here.

- Is this still happening on my time sheets?

- No, the Department universally disabled this feature of Time Clock Plus in August 2021, and no employees or timekeepers should see a difference between recorded time in and actual time in. As part of the new timekeeping policy, employees should review their Complete Payroll Report every two weeks at the conclusion of the pay period.